Your Credit Score can sometimes be the difference between moving into your dream home and living in a crummy rental for eternity. But do any of us really know what a Credit Score is or what it means?

So, this week I applied for a new credit card. Going through the application process and awaiting the outcome, it prompted me to ask myself, what actually determines if I am worthy of receiving credit?

I knew it could have something to do with my Credit Score, but I’d never laid eyes upon mine, let alone knowing what information people making the decisions could actually see about me.

I’m notoriously bad at returning things on time. Could my long history of returning DVD’s and library books late come back to haunt me? How about forgetting to pay my phone bill on the odd occasion? What about the time I was credit card hopping to rack up bonus frequent flyer points? So many questions that had been parked on my ‘to ask’ list, that suddenly seemed a bit more important.

And therein lies the issue. For many people, myself included, the Credit Report is a mythical document that financial institutions use to determine credit worthiness and make critical decisions that could affect people’s futures, yet I didn’t have a clue what mine said about me.

Am I a good person? A bad person? Trustworthy? I had no idea.

Well, since I now work in a Credit Union, I thought this would be a great time to find out.

With a bit of asking around, I was able to find an example credit report to look at and this is the information it contained:

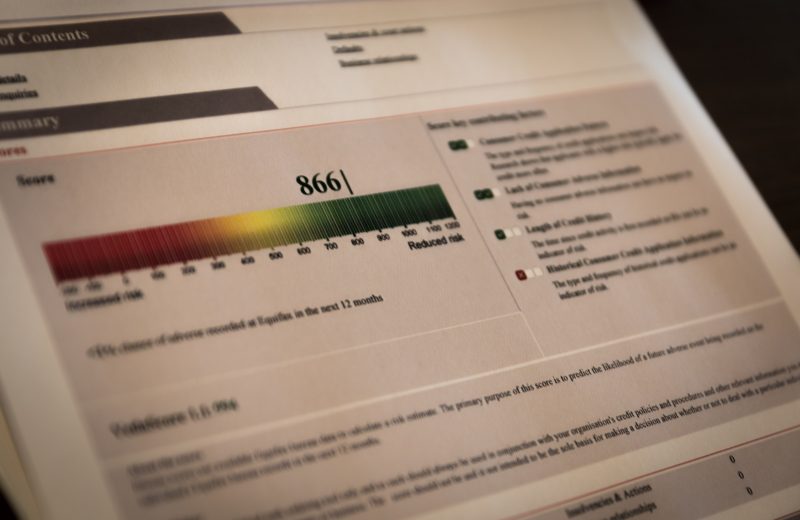

- Credit Score Summary Summarises the contents of your credit report into numbers to provide indication of your risk including a score of -200 to 1200 and key contributing factors to this score.

- Identity Standard identification references including recent addresses and employer.

- Credit Enquiries Identifies who you have applied for credit with, when and for how much

- Insolvencies & Court Actions Highlights any instances of insolvency and court actions

- Defaults Details any defaults you have had in the past

- Business Relationships Any business’s that you own or directorships that you have held, including disqualifications

Okay, so at least I now know what information can be seen in my credit report, but how does this actually affect me?

To find out I asked Justin, our resident Credit Assessor:

James A “Hey Justin, so I’ve just had a look at a credit report and it doesn’t seem as scary or all-encompassing as I was expecting. But I do have a few questions.”

James A “Hey Justin, so I’ve just had a look at a credit report and it doesn’t seem as scary or all-encompassing as I was expecting. But I do have a few questions.”

Justin H “Go for it, James!”

JA “So when I apply for credit, whether it be for a home loan, personal loan or credit card, when and how do you use this report?”

JH “We use the Credit Report during the application process to gain insight into your credit history. We’ll take into consideration various info in the report such as score, defaults and number of credit enquiries.”

JA “So you don’t decide based solely on the Credit Score itself?”

JH “No. The number is not the be all and end all. However, if the score is creeping into the red zone, a score of around 500 or less, that generally indicates there is significant cause for concern, which will become apparent within the report”JA “Okay, I’ve also heard that if a financial institution or business requests my credit report, for instance when I apply for a credit card, this is listed as a credit enquiry and will affect my credit score. Why?”

JH “If we see several applications for credit in a short period of time, we have to work out why this is the case with the limited information we have. This could indicate that you have been declined for credit by one or more financial institutions. It could also mean that you have multiple credit cards or loans that haven’t been disclosed in your application with us. We can see what you applied for and the amount but not the outcome of the application or what you owe to any institution. Therefore we have to make a judgement call”.

JA “I didn’t realise that you couldn’t see what credit cards or loans I have from other institutions, so this makes sense to me. Should I be concerned about having been late on the odd credit card or phone payment or having returned DVDs and library books late?”

JH “This depends on the type of business you have been dealing with. Telecommunication and utilities companies are notoriously trigger happy with reporting late payments to credit reporting agencies, and you may notice this on your report. Whilst these are not great, we’re more likely to overlook one off defaults of this kind if everything else with the application stacks up. However, it’s different if you’ve been reported by a financial institution. As financial institutions go through a rigorous process of trying to resolve issues before reporting them, any issues they have listed on your credit report will hold weight and will negatively affect your standing. As with DVD shops and the like, if the issue has been passed on to a debt collection agency then this would be a red flag for us. Otherwise it’s not really relevant unless we see this as some sort of a larger trend.”

JA “So what if I don’t understand or agree with something on my report such as a default notice?”

JH “If you contact the applicable Credit Reporting Agency, either Dun and Bradstreet or Equifax, they can provide more information or investigate the issue where required on your behalf.”

“One trap that people can fall into is approaching a Credit Repair Agency. In most cases they can only remove default notices from your report if they are incorrect, which is something you can easily do yourself. They may save you a small amount of time but will charge you up to $1,000 for each listing removed. Just be aware of this”

JA “Okay, what if my credit report shows me to be risky, what other actions can I take now to improve my rating?”

JH “Well just remember that each item is removed from your report after five years (or seven years for serious infringements). So the best advice I can give is to keep clean for a while. We will look at your recent statements when you apply for a loan, so we will be able to gauge how likely you are to have future issues based on your current account habits. Make your credit repayments, pay your bills on time and avoid further defaults. Also, don’t apply for credit if you don’t need it, but if you do shop around before you apply. The more enquiries on your account, the lower your score will remain.”

JA “Thanks Justin. Finally where can I actually grab a copy of my credit report?”

JH “This is available from either Equifax or Dun and Bradstreet via their websites http://www.mycreditfile.com.au/products-services/my-credit-file. They’ll usually send you a free copy through the post, or instantly via email for a charge. You can request a free credit score from other third party sites, but expect to receive plenty of promotional calls and emails from their affiliates. Trust me on that one!”

After my chat with Justin I definitely have a better idea of how credit reports are used, but one thing he did mention was to be aware of an impending change to the system, mandatory Comprehensive Credit Reporting. This will have a significant effect on how reporting works in the future. More about this in a future post.